Cumberland County Sales Tax Rate . What is the sales tax rate in cumberland county? The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. The current total local sales tax rate in cumberland county, nc is 7.000%. The sales tax rate in cumberland county, north carolina is 7%. Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales tax rate of 4.75% and local. Listed below by county are the total (4.75% state rate plus applicable. Cumberland county, nc sales tax rate. This figure is the sum of the rates together on the state, county, city, and special. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. 35 rows sales and use tax rates effective october 1, 2020.

from www.ucbjournal.com

The current total local sales tax rate in cumberland county, nc is 7.000%. Listed below by county are the total (4.75% state rate plus applicable. 35 rows sales and use tax rates effective october 1, 2020. Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales tax rate of 4.75% and local. This figure is the sum of the rates together on the state, county, city, and special. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. The sales tax rate in cumberland county, north carolina is 7%. What is the sales tax rate in cumberland county? Cumberland county, nc sales tax rate.

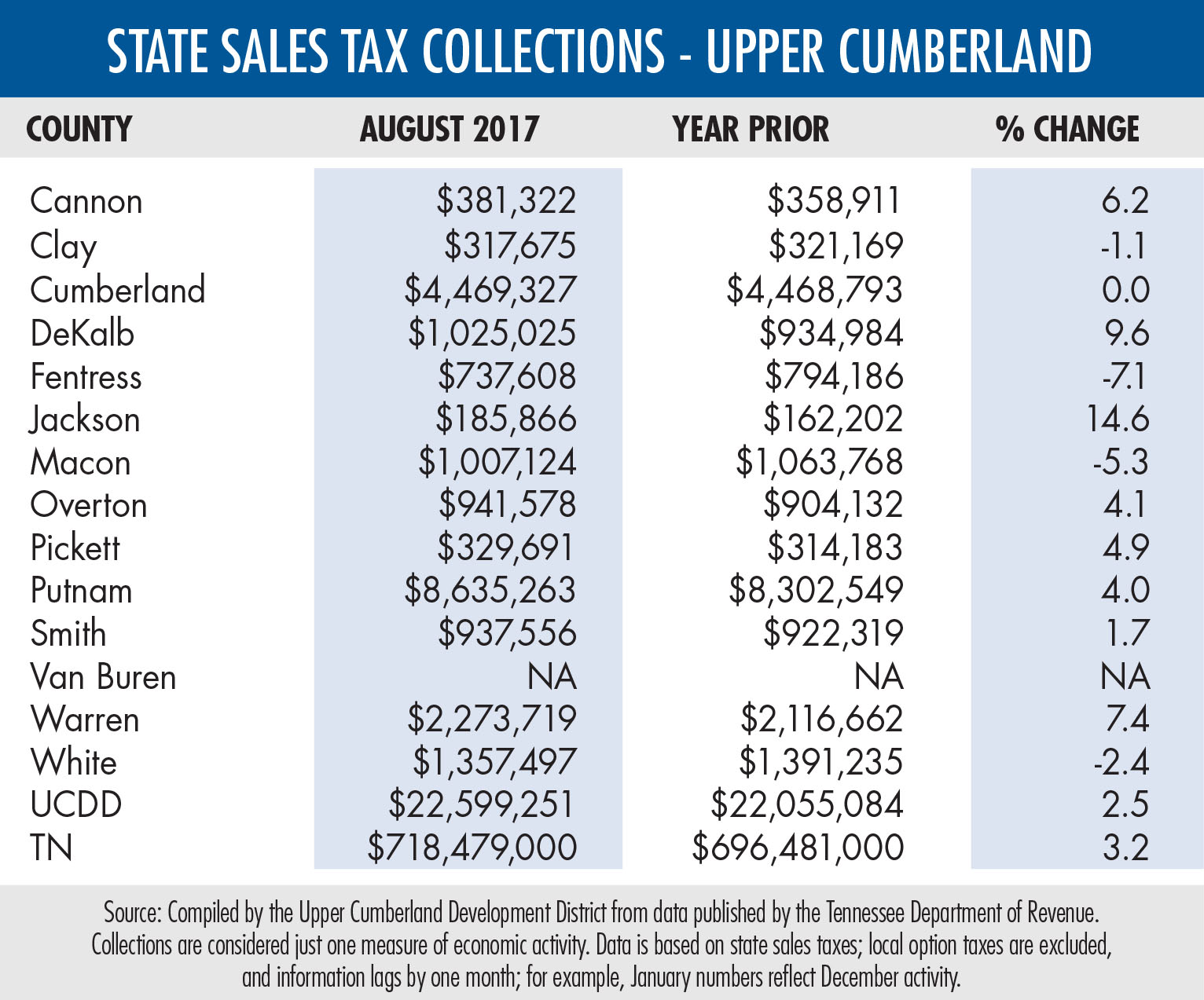

Regional sales tax numbers dip slightly, remain strong UCBJ Upper

Cumberland County Sales Tax Rate Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales tax rate of 4.75% and local. What is the sales tax rate in cumberland county? Listed below by county are the total (4.75% state rate plus applicable. 35 rows sales and use tax rates effective october 1, 2020. The sales tax rate in cumberland county, north carolina is 7%. Cumberland county, nc sales tax rate. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. The current total local sales tax rate in cumberland county, nc is 7.000%. This figure is the sum of the rates together on the state, county, city, and special. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales tax rate of 4.75% and local.

From www.youtube.com

Cumberland County Tax Administration How to View Your Property Record Cumberland County Sales Tax Rate The sales tax rate in cumberland county, north carolina is 7%. Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales tax rate of 4.75% and local. Listed below by county are the total (4.75% state rate plus applicable. The current total local sales tax rate in cumberland county, nc is. Cumberland County Sales Tax Rate.

From www.pdffiller.com

Fillable Online CUMBERLAND COUNTY TAX MAP REQUEST FORM Fax Email Print Cumberland County Sales Tax Rate This figure is the sum of the rates together on the state, county, city, and special. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. Listed below by county are the total (4.75% state rate plus applicable. Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales. Cumberland County Sales Tax Rate.

From www.mapsales.com

Cumberland County, VA Wall Map Premium Style by MarketMAPS MapSales Cumberland County Sales Tax Rate Listed below by county are the total (4.75% state rate plus applicable. The sales tax rate in cumberland county, north carolina is 7%. This figure is the sum of the rates together on the state, county, city, and special. Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales tax rate. Cumberland County Sales Tax Rate.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Cumberland County Sales Tax Rate 35 rows sales and use tax rates effective october 1, 2020. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. Cumberland county, nc sales tax rate. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. The sales tax rate in. Cumberland County Sales Tax Rate.

From www.countyforms.com

Cumberland County Pa Local Earned Tax Return Cumberland County Sales Tax Rate Listed below by county are the total (4.75% state rate plus applicable. 35 rows sales and use tax rates effective october 1, 2020. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. This figure is the sum of the rates together on the state,. Cumberland County Sales Tax Rate.

From www.pennlive.com

Cumberland County businesses Can tax relief and economic growth Cumberland County Sales Tax Rate The sales tax rate in cumberland county, north carolina is 7%. The current total local sales tax rate in cumberland county, nc is 7.000%. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. What is the sales tax rate in cumberland county? 35 rows sales and use tax rates effective october 1, 2020. Cumberland county in. Cumberland County Sales Tax Rate.

From www.forsaleatauction.biz

Cumberland County, VA Tax Delinquent Real Estate Cumberland County Sales Tax Rate The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. The sales tax rate in cumberland county, north carolina is 7%. Cumberland county, nc sales tax rate. Listed below by county are the total (4.75% state rate plus applicable. What is the sales tax rate. Cumberland County Sales Tax Rate.

From www.forsaleatauction.biz

Cumberland County, VA Tax Delinquent Real Estate Cumberland County Sales Tax Rate The current total local sales tax rate in cumberland county, nc is 7.000%. This figure is the sum of the rates together on the state, county, city, and special. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. Cumberland county, nc sales tax rate.. Cumberland County Sales Tax Rate.

From ephemeralnewyork.blogspot.com

cumberland county va tax map Zita Shannon Cumberland County Sales Tax Rate Listed below by county are the total (4.75% state rate plus applicable. The current total local sales tax rate in cumberland county, nc is 7.000%. Cumberland county, nc sales tax rate. The sales tax rate in cumberland county, north carolina is 7%. Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina. Cumberland County Sales Tax Rate.

From audriebmadlen.pages.dev

Ohio State Sales Tax Rate 2024 Map Liuka Prissie Cumberland County Sales Tax Rate The minimum combined 2024 sales tax rate for cumberland county, north carolina is. The current total local sales tax rate in cumberland county, nc is 7.000%. The sales tax rate in cumberland county, north carolina is 7%. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7%. Cumberland County Sales Tax Rate.

From www.countyforms.com

How Do I Fill Out Cumberland County Tax Forms Cumberland County Sales Tax Rate The sales tax rate in cumberland county, north carolina is 7%. 35 rows sales and use tax rates effective october 1, 2020. Listed below by county are the total (4.75% state rate plus applicable. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. The current total local sales tax rate in cumberland county, nc is 7.000%.. Cumberland County Sales Tax Rate.

From taxfoundation.org

State and Local Sales Tax Rates in 2016 Tax Foundation Cumberland County Sales Tax Rate Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales tax rate of 4.75% and local. The current total local sales tax rate in cumberland county, nc is 7.000%. What is the sales tax rate in cumberland county? Cumberland county, nc sales tax rate. The minimum combined 2024 sales tax rate. Cumberland County Sales Tax Rate.

From www.pennlive.com

Cashstrapped Cumberland County town raises property taxes 50 Cumberland County Sales Tax Rate This figure is the sum of the rates together on the state, county, city, and special. The current total local sales tax rate in cumberland county, nc is 7.000%. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. Cumberland county, nc sales tax rate.. Cumberland County Sales Tax Rate.

From adoregerianna.pages.dev

Ohio State Sales Tax Rate 2024 Lok Jenn Robena Cumberland County Sales Tax Rate Cumberland county in north carolina has a tax rate of 7% for 2023, this includes the north carolina sales tax rate of 4.75% and local. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. The current total local sales tax rate in cumberland county,. Cumberland County Sales Tax Rate.

From barrieconstancia.pages.dev

California State Sales Tax Rate 2024 2024 Lesli Janeczka Cumberland County Sales Tax Rate The sales tax rate in cumberland county, north carolina is 7%. Cumberland county, nc sales tax rate. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. The current total local sales tax rate in cumberland county, nc is 7.000%. What is the sales tax rate in cumberland county? Cumberland county in north carolina has a tax. Cumberland County Sales Tax Rate.

From www.formsbank.com

Cumberland County Real Estate Tax Sale Registration Form printable pdf Cumberland County Sales Tax Rate Listed below by county are the total (4.75% state rate plus applicable. The sales tax rate in cumberland county, north carolina is 7%. This figure is the sum of the rates together on the state, county, city, and special. 35 rows sales and use tax rates effective october 1, 2020. The minimum combined 2024 sales tax rate for cumberland county,. Cumberland County Sales Tax Rate.

From madelenawjeane.pages.dev

Mass Sales Tax Rate 2024 Eudora Malinda Cumberland County Sales Tax Rate The current total local sales tax rate in cumberland county, nc is 7.000%. The minimum combined 2024 sales tax rate for cumberland county, north carolina is. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. Cumberland county in north carolina has a tax rate. Cumberland County Sales Tax Rate.

From www.forsaleatauction.biz

Cumberland County, VA Tax Delinquent Real Estate Cumberland County Sales Tax Rate This figure is the sum of the rates together on the state, county, city, and special. The local sales tax rate in cumberland county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of. Cumberland county, nc sales tax rate. The current total local sales tax rate in cumberland county, nc is 7.000%.. Cumberland County Sales Tax Rate.